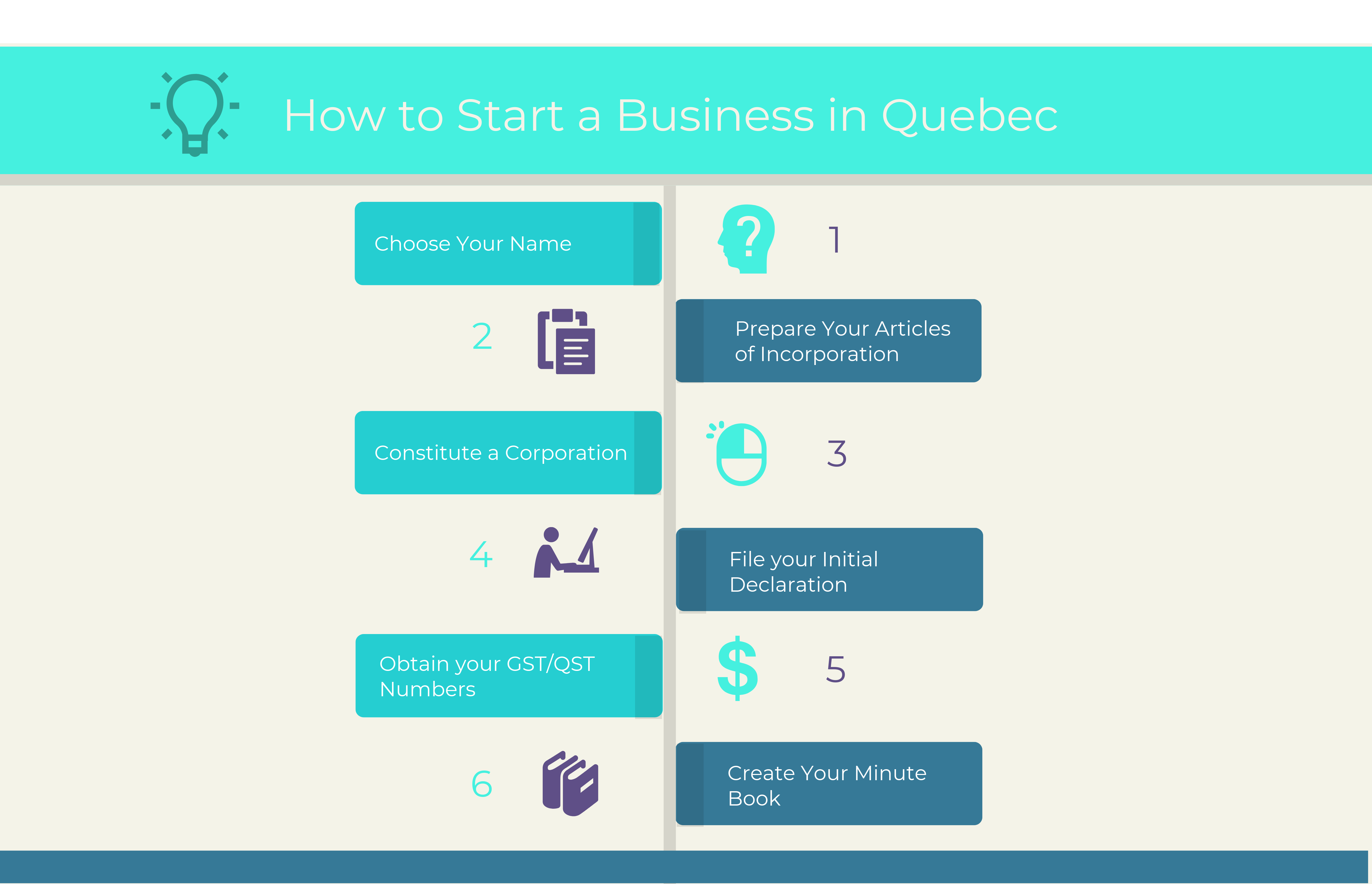

How to Start a Business in Quebec

Incorporate a business corporation in Quebec with these simple steps.

Your step-by-step guide to incorporating a business in Quebec. Yes, you read that right. We’re spilling the beans on how you can incorporate a business in Quebec, by yourself.

This article will take you through the step by step process to starting a business in Quebec. From choosing your name, filing your articles of incorporation, getting your sales tax numbers and creating your minute book, we cover it all. Starting a business in Quebec can be a simple process and you can do it too.

Step 1: Choose Your Name

In Quebec, you have the option to incorporate a numbered company (ex. 9123-4567 Quebec Inc.) or incorporate a corporate name (ex. ABC Consulting Inc.).

Numbered Company

If you choose to incorporate a numbered company, the online service at the Quebec Corporate Registry will designate a number for your company.

Corporate Name

On the other hand, if you choose to incorporate a corporate name, you will have to follow a set of guidelines:

- For any Quebec-based business, the name of your business must have a French element.

- Your name should be composed of three different components:

- A generic component: This component will provide a general indication of the enterprise (ex. Boutique, Consulting, Agency, Music…etc.)

- A specific component: This component is the one that distinguishes your business from other businesses. (ex. ABC, TBSL, PIXI)

- A particle component: This component is often the variation that clarifies the legal form of your business (ex. Inc., corp, corporation, S.EN.C., S.E.N.C.R.L.)

With all three components, your registered business name would look something like this:

Consultant TBSL inc.

Boutique PIXI inc.

ABC Capital Corporation

- You need to ensure that your name complies to all language and business laws in Quebec:

- Your name must be in French

- The name cannot contain an immoral, obscene or scandalous expression or idea

- The name must not incorrectly indicate the legal status of the business

- The name cannot indicate that it is a not-for-profit corporation or a public authority or that the business is linked to any such organization

- The name cannot indicate that it is related or linked to another person or corporation in such a way as to confuse or deceive the public (ex. Apple Quebec Inc.)

- The name must not already be in use by another person, corporation or group of persons in Quebec

- The name cannot contain an expression or word that the law has reserved for others or use they prohibit

- Once you have chosen your name, you will need to then ensure that the chosen name is not already taken by another company.

There is a common misconception that in order to do this, you must pay and reserve a business name at the Quebec Corporate Registry. In fact, in Quebec, this is not obligatory.

However, in order to find if your name is already taken, you can simply search the Quebec Corporate Registry for your chosen name. If no name appears, then the name is likely available.

To be extra cautious, we do recommend checking the federal registry as well as all federal corporations must comply with the NUANS database which is a database comprised of all business names and trademarks in Canada.

When registering your business name, you can keep a few things mind:

- Your business will have an official name (ex. Boutique PIXI Inc.), however your business may want to exercise its activities under a shorter catchier name (ex. PIXI). In this case, you would register “PIXI” as the “other names” or “assumed names” of your business on the Quebec corporate registry.

- Even if the Quebec corporate registry requires that your name includes a French element, please note that you are allowed to have two official business names in each language (English and French). Therefore, you can have one official business name that is “Consultation TBSK Inc.” and another that is “TBSK Consulting Inc.”

Step 2: Prepare Your Articles of Incorporation

Once you have your corporate name or numbered company number, you must then prepare your articles of incorporation which are filed at the Quebec Corporate Registry. Your articles of incorporation are the legal documents that are submitted to the Provincial or Federal registry that include the following:

- The official name of your business and the “other versions” of your name

- The full registered head office address of the corporation

- The number of directors of the corporation

- The full names of the directors of the corporation and their addresses

- Description of Share Capital (ex. Share Class, Voting Rights…etc.)

- Restriction on Transfer of Securities or Shares

- Limits on Activities of the Corporation

- Other Provisions

- Full name and signature of the founders of the business

When filing this information at the registry, you will have to attach your description of share capital, restrictions on the transfer of securities or shares, limits on the activities of the corporation and other provisions with your articles. What are these documents and how do you draft them?

- Description of Share Capital

Your description of share capital will describe the type of common and preferred stock your company will be issuing. In each class of shares, you will have to include if your shares have a par value, are entitled to receive dividends, if they can participate in then event of a liquidation or dissolution, purchase rights, voting rights, redemption rights and restrictions, if any.

For example, your “Class A” shares can be without a par value, be entitled to receive dividends and can participate in the event of liquidation or dissolution.

- Restriction on Transfer of Securities or Share

In this section, you will have to establish if your securities or shares will have transfer restrictions.

For example, you can state that your shares cannot be transferred without the consent of the Board of Directions evidenced by resolution.

- Limits on Activities of the Corporation

In this section, you will have to establish if there will be limits placed on your company’s business activities.

You are allowed to put no limits or you can establish a specific limit.

- Other Provisions

This section will include any other provision that you want to add into your articles of incorporation.

Step 3: Constitute a Corporation

Once you have your articles of incorporation prepared, you will have to access the Quebec Corporate Registry and constitute a corporation.

In this section, you will have to include the information described in step 2 and you will have to file the documentation described in step 2.

Step 4: File Your Initial Declaration

Once your company is constituted, you will need to file an initial declaration at the Quebec Corporate Registry. The initial declaration is a more in-depth application regarding your articles of incorporation.

In this section, you will be including:

- The “other names” or “assumed names” that your business may be operating under

- The full names and addresses of each director of the corporation

- The position of each director of the corporation (President, Vice-President, Secretary, Treasurer)

- The full names and addresses of the shareholders of the corporation

- The activities of your corporation

- The number of employees

- Full name and signature of the one of the founders of the business

Step 5: Obtain Your Sales Tax Numbers (GST/QST)

Once your company is officially incorporated, you need to obtain your GST/QST tax numbers.

To register to obtain your sales tax numbers, you will need to contact Revenue Quebec. Be prepared as Revenue Quebec will need certain information from you before registering the company.

You will need to provide them with the following information:

- Business Number of the Corporation (NEQ Number)

- Name of the Corporation

- Names, home address, phone numbers and social insurance numbers of each director of the corporation

- Financial Year End of the Corporation (ex. December 30 or June 30)

- Will you want to pay your taxes on a monthly, quarterly or annual basis?

- Will you want your documentation in English or in French? (Please note that only the GST is provided in English if requested. The QST documentation is strictly provided in French)

- What is the estimated revenue of the company?

Step 6: Create Your Minute Book

Once you have incorporated your company and obtained your sales tax numbers, you will need to create your minute book. A minute book is a permanent and detailed record of your corporation’s rules, activities and decisions. It will contain the following:

- Articles of Incorporation

- By-Laws of the Corporation

- Resolutions of Corporate Minutes and Meetings

- List of the Board of Director Members

- List of the officers of the Corporation

- List of the Shareholders

- Securities Registry

- Share Certificates

- List of the significant positions of the Corporation and who has the authority to act in the name of the corporation

In Quebec, having a minute book is mandatory and your book should be available at your corporation’s headquarters or at another location designated by the Corporation (ex. Lawyer’s office).

This is often the most overlooked part of starting a business. Not having a proper minute book that is up to date with the proper documentation from the beginning stages of your business can be detrimental.

Step 7: Get to Work

Congratulations! You’re finally incorporated! Now, you can get to work and build your dream business. Best of luck!

For more information on starting a business in Quebec, please visit our business incorporation page.