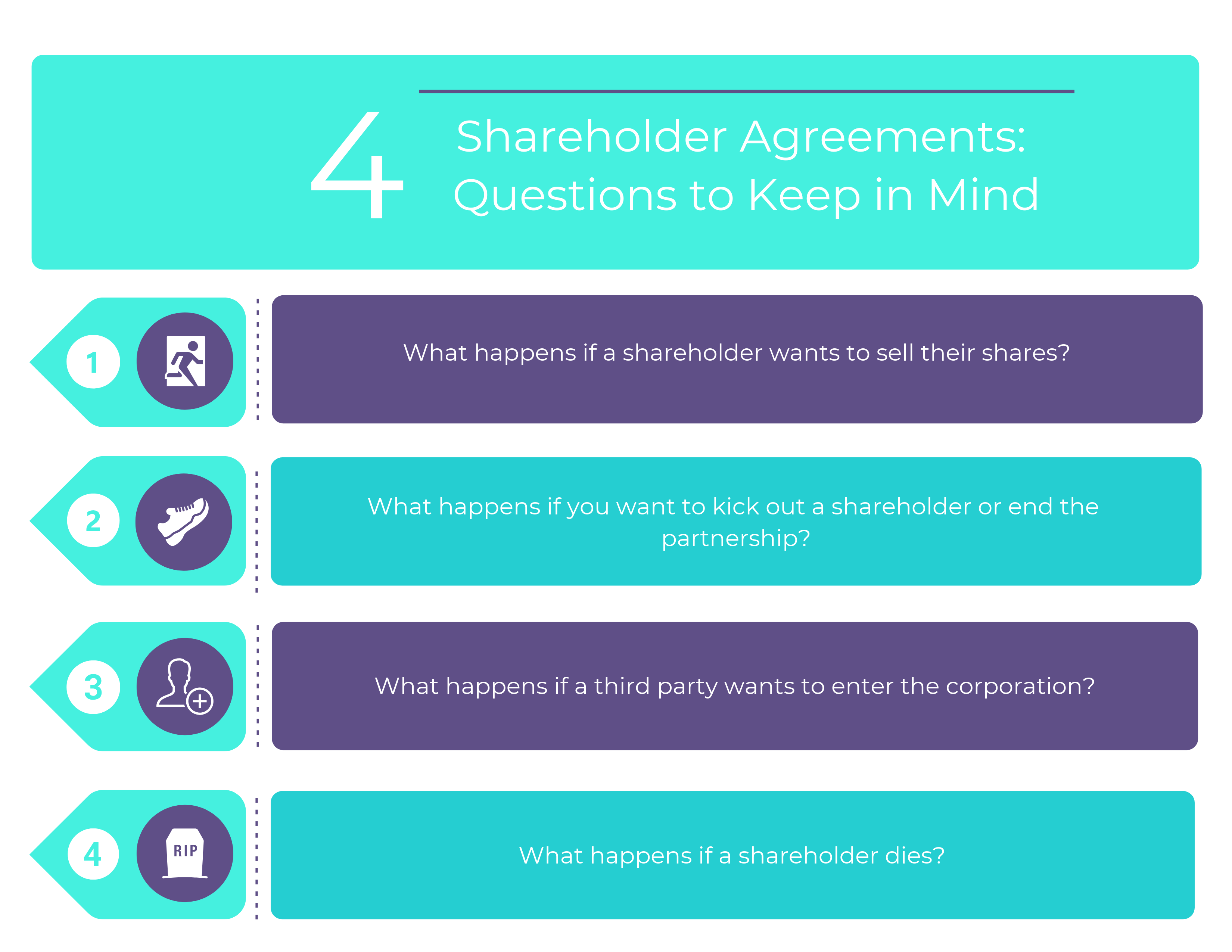

Shareholder Agreements in Quebec: 4 Questions to Keep in Mind

You have a corporation and you have a great business partner – but you and your business partner have not yet established any of terms of your relationship. Like any other relationship, you need to know how to handle certain situations if they arise, for instance:

-

-

What happens if one of the shareholder dies?

-

What happens if one of the shareholders wants to leave the corporation?

-

What happens if you want to leave the corporation?

-

What happens if a shareholder wants to bring in another shareholder into the corporation?

-

What happens if a majority shareholder wants to sell their shares to a third party?

-

You might not have the answers to these questions – that’s why shareholder agreements are pivotal for any corporation. Shareholder agreements are most valuable when certain problematic situations arise in a corporation. By signing a shareholder agreement at the start of the partnership, the shareholders will establish a set of rules and guidelines to handle these situations and to avoid the additional headache associated therewith. These are some of the questions shareholders should keep in mind.

What happens if a shareholder wants to leave the partnership?

A. Right of First Refusal

A well drafted Shareholders’ Agreement should indicate what will happen should a shareholder want to sell their shares in the corporation. Typically, the shareholder agreement will include a “right of first refusal” clause which will essentially allow the other shareholders of the corporation to purchase the shares of the existing shareholder before they are offered to a third party.

In this case, the shareholder who wishes to sell their shares will provide notice to all the other shareholders in the corporation who will then have the first chance to either purchase or refuse the shares. In most cases, the clause will set out how the notice will be given and how long the shareholders will have to respond – typically it is within a 30-day delay.

Additionally, the right of first refusal clause should address what will happen if all the shareholders or more than one shareholder offers to purchase the shares. In this case, the selling shareholder will most likely have to sell their shares on a pro-rata basis, based on the proportionate shareholding of each shareholder.

Finally, the right of refusal clause should state how the shares will be transferred and in the event the selling shareholder does not transfer the shares when required, how the situation will be resolved.

This clause is particularly important when dealing with small businesses who have very few shareholders. In this case, it allows the shareholders to prevent having an undesirable third party join the partnership without their consent – or even more so having an undesirable third party obtain controlling interest in the corporation.

B. Non-Competition and Non-Solicitation Clause

If a shareholder plans on leaving the corporation and was privy to certain confidential proprietary information, it is useful for the shareholders to include a non-competition and non-solicitation clause in the shareholders’ agreement.

The non-competition clause can prevent the selling shareholder from directly competing with the corporation for a certain period of time after leaving the corporation. On the other hand, the non-solicitation clause can prohibit the selling shareholder from soliciting other shareholders, employees, directors, officers or clients of the corporation to leave the corporation for another.

What happens if you want to kick out a shareholder or end the partnership?

A. Shotgun Clause (also known as a “buy/sell clause”)

The Shareholder Agreement should indicate what will happen should a shareholder want to kick out a fellow shareholder and end the partnership. In this case, a “shotgun” clause also known as a “buy/sell” clause is typically added in a shareholder agreement as a form of dispute resolution.

The shotgun clause is used to force a shareholder into either buying out an offering shareholder or selling their shares to the offering shareholder at the same price. Therefore, the target shareholder will have the option of either buying out their partner or selling their shares to their partner. Typically, the clause will set out how the target shareholder will be notified of the ignition of the shotgun clause and how long he will have to respond to same – normally within a 30-day delay.

What happens if a third party wants to enter the partnership?

In some cases, a corporation will have several shareholders, some with minority shares and others with majority shareholdings. In this event, it is particularly useful for the shareholders to anticipate what will happen should a majority shareholder with a controlling interest want to sell their shares to a third party. This is typically done by including a “tag-along” or “drag-along” clause in a shareholder agreement.

A. Tag-Along Clause

In a tag-along clause, also known as “piggy-back rights”, a minority shareholder can force a majority shareholder wishing to sell their shares to a third party to also sell the minority shareholder’s shares at the same price and on similar terms.

Therefore, in this case, if the third party wishes to purchase the majority shareholder’s shares, they must be prepared to purchase any outstanding minority shareholder shares.

This clause is particularly useful to protect minority shareholders in the event of a third-party buy-out. For instance, if a minority shareholder had only 10% shares in the company, it would be particularly difficult for them to sell their shares. Thus, this clause will force them to sell their shares at a price substantially lower instead of finding themselves with unsalable or devalued shares after the sale.

B. Drag-Along Clause

On the other hand, a drag-along clause can allow a majority shareholder to force a remaining minority shareholder to also sell their shares to a third party who wishes to acquire the whole of a company. In this case, the majority shareholder will have to offer the minority shareholders the same price, terms and conditions that he or she has been offered for their majority shares.

This clause is typically used as a means to provide majority shareholders with a flexible exit strategy. Since most buyers will refuse to purchase a company if they do not have 100% control of the business, this allows majority shareholders to ease the process and prevent minority shareholders from blocking the sale – or even more so being uncooperative with the new majority shareholder.

What happens if a shareholder dies?

Finally, new shareholders in a corporation, should always think about what will happen should one of the shareholders die. According to Quebec devolution laws, when a shareholder dies, his shares in the corporation will go to his estate. Thus, the estate will become the other shareholder in the corporation, which can lead to a potentially undesirable result.

As such, it is pivotal for shareholders to include a clause whereby the corporation will be able to redeem the deceased shareholder’s shares in the corporation. Additionally, the shareholders should establish a redemption price for the shares at the date of the signing of the shareholder agreement in order to prevent having to pay an exorbitant price for the shares, should the company exponentially grow.

To conclude, it is pivotal for shareholders in a corporation to sign a shareholders’ agreement at the beginning of the partnership and to keep some of these questions in mind. Providing for the correct exit strategy or correct procedure to deal with certain issues at the start of the relationship can create great ease between the partners should a potentially unpleasant situation occur.

For more information on shareholder agreements, please visit our shareholder agreement page here or contact us for more details.